Typical CE transactions result in a 30% to 100% assessed devaluation, a decrease not confined only to CE-burdened lands: the devaluations can spill to neighboring, non-participating landholders, reducing their property values as well.

by Marjorie Haun

Kansas Natural Resources Coalition (KNRC) is a relatively new organization with a timeless mission:

KNRC Mission Statement –

The Kansas Natural Resource Coalition (KNRC) is an association of counties who maintain collective and participatory involvement in administrative government on behalf of its citizenry. The Coalition serves as a conduit between local, state and federal governments to promote balanced, necessary and effective administrative policymaking through the mechanism of government-to-government coordination.

Since it was formed in March of 2013, KNRC has had an impact on local and national natural resources policy. The member counties of KNRC use scientifically-based insight and knowledge of existing law to impact policies which are of interest to property owners, ranchers, farmers, and rural communities across the country. KNRC is not afraid to take on federal policies, such as the Endangered Species Act, or the aggressive and well-funded special interests which abuse such policies to exert control over land and resources.

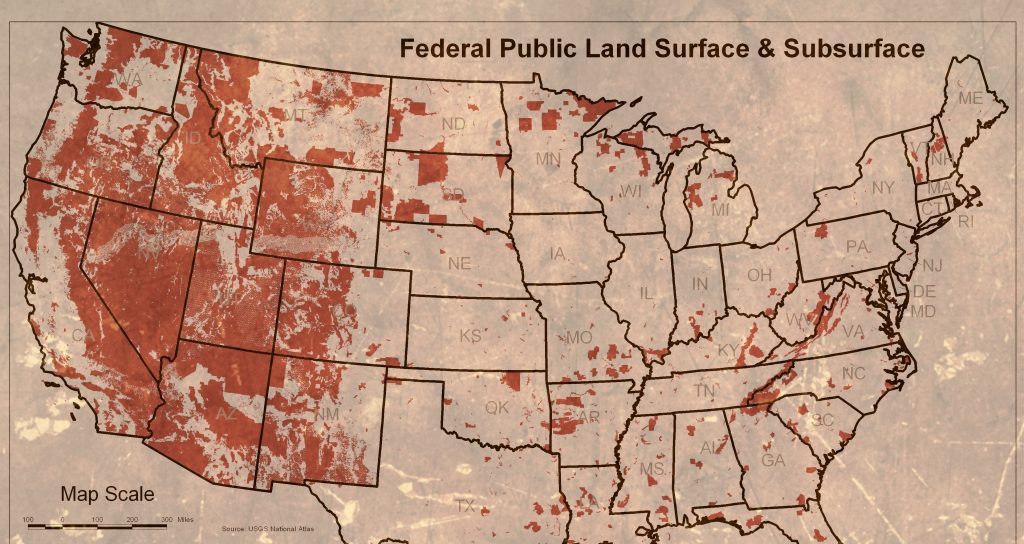

Smack in the center of KNRC’s cross hairs are ‘conservation easements.’ Although states and localities have a variety of rules governing conversation easements–aka ‘conservation lands’ or ‘conservation trust lands’–they are in essence a deal with the devil in which private property owners cede future control over the use and/or disposal of their own lands. Numerous ‘conservation groups,’ such as the Nature Conservancy, provide a means by which privately-held lands are conveyed to the federal government, thus being put off-limits to resource development of any kind.

KNRC’s website describes Conservation Easements this way:

Conservation Easements (CEs) are title encumbrances that impose enforceable development, management and land use restrictions on real property. CEs qualifying for a tax exemption under IRS 170(h) Rules require monitoring by land trusts, third party non-profit organizations holding legal entitlements to access, monitoring, enforcement and a host of other controls over the landowner’s property.

The philosophy undergirding CEs is relatively new, having been codified at the national level by Uniform Conservation Easement Act (UCEA). UCEA was quickly adopted into the statutes of most states, and it — along with the federal IRS tax exemption — have effectively injected the federal government into county land use policy through reduction of property valuations and imposition of natural resource and land management restrictions.

The original concept behind conservation easements came from the desire to protect unique, rare and historic lands, such as the Grand Canyon, Yellowstone or Yosemite National Park from development. However, the outworking of CE policy at the local level, in particular in-perpetuity requirements, resource sequestration, large-scale imposition of buffer zones on private property, and valuation reductions has provided fertile ground for mischief, abuse and litigation.

Significant gaps exist in CE policy, in particular regulation, monitoring, and mandatory standards necessary to oversee unscrupulous land trusts and agents. No uniform regulatory system exists that inhibits land trusts from negotiating CEs, collecting fees and tax benefits, and then from abandoning their in-perpetuity monitoring responsibilities. Indeed, records from a KNRC public hearing, testimonies, studies, and state-wide tax issues all indicate prolific problems with CEs and CE policy.

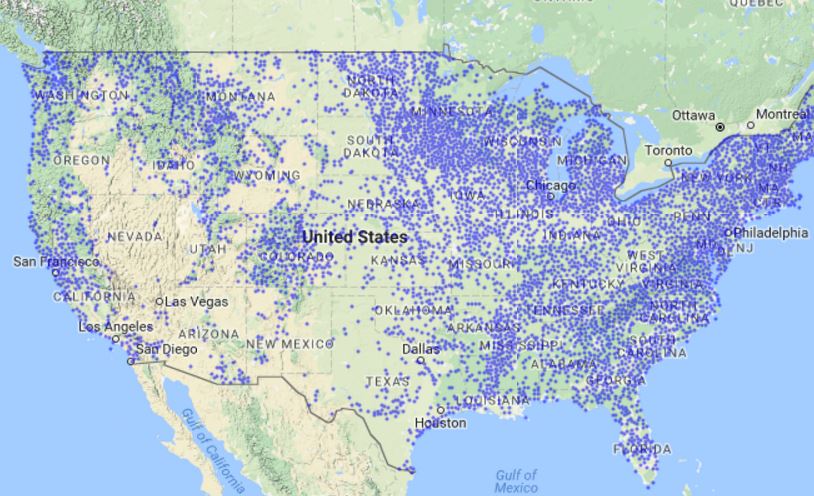

Proponents of CEs point to their right to make permanent decisions for properties they own; opponents (and historical provisions in common law) counter that the ownership rights, preferences, and prerogatives cease upon death — or a reasonable period thereafter — of the land owner.KNRC is active in following and participating in CE public policy. This includes monitoring of the effects of land devaluation, understanding of long-term tax implications to county governments, protection of adjacent landholders from buffer zones, and promotion of CE transfer and threatened/endangered species notification requirements. Maps and a database of CE lands can be viewed here.

With an alarming proliferation in conservation easements (CEs), KNRC tracks CE proposals, monitoring for possible title abuses involving land devaluation and property tax issues. KNRC also explores the abusive use of endangered species ‘corridors’ in CE proposals.

Few Americans are aware of the degree to which CE’s decrease land values. KNRC provides some startling facts on their website:

- Typical CE transactions result in a 30% to 100% assessed devaluation, a decrease not confined only to CE-burdened lands: the devaluations can spill to neighboring, non-participating landholders, reducing their property values as well.

- Under IRS 171 Rules, one requirement to achieve the maximum estate tax benefit is that the CE must result in 30% minimum land devaluation – and it must encumber the land in perpetuity (forever).

- Under Kansas law KSA 79-1476, lands enrolled in the Federal Conservation Easement Wetlands Reserve Program (WRP) must be re-classified as “native grassland” for the purpose of property tax valuation.

- Reclassification of land devalues property and erodes the local tax base as land market-values decrease. No provision at the Federal or State level has, to date, been made to recognize or compensate for devaluations realized at the local level.

Many landowners who take on CE’s do so believing that they are in a ‘private-public partnership’ (PPP), and will have an equal say about what occurs on their property. KNCR warns that the truth is very different. According to KNRC:

Public-Private Partnerships (PPPs) are complex, joint undertakings between Public (Federal Agencies) and private entities, such as international Non Governmental Organizations (NGOs) and other Quasi-governmental (QGAs) entities.

PPPs confuse the authoritative role of Federal agencies, blur geopolitical boundaries of State and Local Governments and inject powerful, corrupt, well-funded, multinational environmental groups into local, natural resource policymaking by creating a false legal standing and the mirage of legitimate, external interest.

The USDA Agriculture Conservation Easement Program (ACEP) provides grant programs to eligible parties – including NGOs – for the purchase of Conservation Easements (CEs). Land Trusts, often the recipient of CEs through NGOs, are given substantial contractual enforcement rights against local landowners – rights that often result in hundreds of thousands of dollars in legal costs and draconian management burdens to ranchers and farmers.

And, although KNRC focuses primarily on Kansas law and policies, they sound a warning to all states and localities about the tax implications of CE’s. Their website summarizes, “Tax implications resulting from in-perpetuity Conservation Easements are a reduced tax base, which penalizes all taxpayers of non-encumbered properties with a disproportionate tax burden.”

KNRC’s county members are well-versed in both local government as well as the management and development of natural resources, citing the 10th Amendment as the final word on the powers of counties:

Significant confusion exists at all levels and throughout all branches of government as to who-has-what power, while at the same time there appears no shortage of officials willing to avert responsibility. KNRC’s approach to sorting the legitimacy of proposed Federal Rules is demonstrated by first understanding that local government – that is, County Commissioners – retain 10th Amendment police powers and have responsibility for the health and safety of their citizens.